10.09.2019

September 2019 – Component Obsolescence Set to Continue

Published on: 10/09/2019

Technology changes, shorter product life cycles and the consolidation of designs could result in more components reaching end of life

Component obsolescence has always been a problematic area for buyers, purchasers and procurement specialists within the power electronics industry, but the likelihood of products with long product lifecycles being made obsolete is becoming extremely common today. The reason for this is because OCM’s (original component manufacturers) are looking to consolidate their products by offering a dual purpose device that can provide better performance by replacing three or more separate devices.

How to tackle component obsolescence

Consolidating product ranges allows OCM’s to focus on the production of fewer devices, this allows mass production of fewer parts which ultimately speeds up time to market for customers. The ability to speed up production in factories is one of OCM’s top priorities when the market is in high demand like it is at the moment, the industry is working to tight deadlines but lead times are still at 34 weeks+ which is putting a strain on the component industry. The increased demand of semiconductors over the past two years has mainly been an impact of the amplified production of electric vehicles which as a result has pushed lead times out to as long as 52 weeks by some manufacturers.

When demand for components is high and the OCM’s are not producing components fast enough to service the demand, they will look to prioritise the production of their most popular devices and will decide whether or not to make underperforming devices obsolete in order to ease the production flow. While component obsolescence is not a new issue, it is becoming more acute within the industry. Recent consolidation in the supply base, coupled with mergers and acquisitions, transitions to new technologies and the changing demands of new systems has resulted in a higher rate of component obsolescence. When two companies merge it is quite common for the low-volume and redundant lines to be eliminated from the product portfolio.

When PCNs (product discontinuation notices) are announced and buyers are made aware of component obsolescence, they should determine their own demand for parts over the next five years and assess whether it’s worth designing in a new part and phasing out the old device or just searching the market for existing stock. If the demand is relatively small and stock is likely to be on the market, then customers have two options; to purchase a lifetime buy or to source devices on the open market. Buyers should partner with their distributor or the factory direct in some cases, to discuss a lifetime buy.

A lifetime buy will only be available for a set period of time and should be explored as soon as the PCN has been issued to secure the stock and unit price. Distributors are a reliable source to organise lifetime buys because they will be one of the first to receive the notice and can move quickly to secure the stock.

If the buyer decides to source the parts on an open market they need to be prepared to potentially pay more for the parts than what they have previously ordered them at, and to spend more time sourcing the component through various channels as stock will be limited. A buyer would be strongly recommended to partner with their preferred distributor to source these devices, this will help them save time and money because the distributor will be better informed of product availability an d will know the best channels to source the devices.

If the demand is far greater than what a lifetime buy can offer, then buyers should explore the option of designing in a new part working closely with the manufacturer and in most cases their preferred distributor if they do not have a direct account.

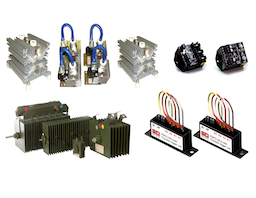

GD Rectifiers is a global manufacturer and distributor of products, services and solutions to the commercial and industrial users of power electronic components. We work closely with our customers on component obsolescence, lifetime buys, scheduled orders, call-off orders and designing in new products to meet the strictest requirements.

GD Rectifiers works as an extension to your business, we source the components you need on time and within budget, we have access to components from over 30 of the world’s leading manufacturers and stock over 170,000 components at our factory in West Sussex, with the ability to pull in non-stocked product lines quickly to ensure we deliver your products when you need them. We take pride in our customer service, we source the components you need quickly so you have time to focus on other areas of your role, securing you the best possible price and notifying you of any product availability issues or phase out plans, we also provide expert technical support and aftercare.

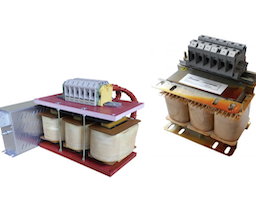

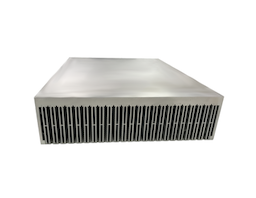

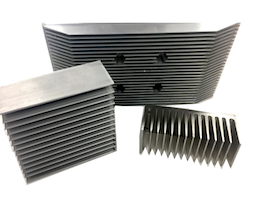

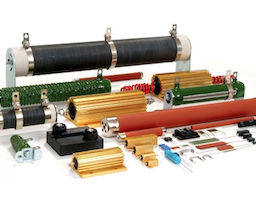

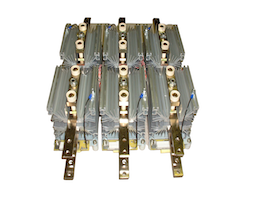

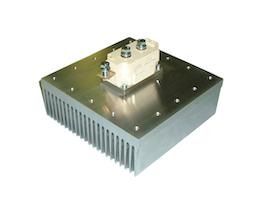

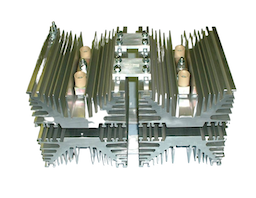

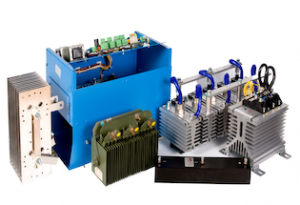

GD Rectifiers offers a vast product range of semiconductor components, power assemblies and controllers, heatsinks and hardware, circuit protection devices, magnetic transducers and wound products, passive components and traction converters and subsystems. We partner with leading manufacturers IXYS, Semikron, Westcode, EDI, Eaton Bussmann and Mersen to offer over 170,000 components from stock.

For further information on GD Rectifiers’ extensive range of components or to discuss your product requirements, please call: 01444 243 452 or email: enquiries@gdrectifiers.co.uk.